What is Verification?

Verification is a process in which information on a student’s Free Application for Federal Student Aid (FAFSA) is reviewed by a school for accuracy and completeness. Each year, the Federal U.S. Department of Education selects certain applicants for verification. The verification process requires the Office of Financial Aid to confirm the data supplied by the student and/or parent(s). Although the college cannot determine who will be selected for verification each year, students should anticipate selection. If your FAFSA is selected for verification, immediately submit all requested documentation to our office for review. Failure to provide required documentation by stated deadlines will affect the timely delivery of award package by posted payment deadline dates.

The 2023 – 2024 Verification Documentation Deadline is Friday, June 30, 2024

All students selected for verification must submit the appropriate documentation to the Office of Financial Aid. This may include, but is not limited to:

- An Independent/Dependent verification worksheet, with all items completed and student/parent or student/spouse signatures included

- IRS Data Retrieval Tool or Tax Return Transcripts

- Any applicable tax schedules (i.e., C or F) for student/parent or student/spouse

- All student/spouse W-2 form(s) or 1099-MISC form(s) for total wage income*

- All parent W-2 form(s) or 1099-MISC form(s) for total income *

- Parent verification of non-tax filing if parents did not file taxes

- Parent Statement of Financial Support (if requested)

- Statement of Educational Purpose

- Proof of high school or equivalent completion

*NOTE REGARDING TAX DOCUMENTS:

The FAFSA use two year’s prior tax information. Since you’ll already have filed your taxes for two years ago by the time the FAFSA form launches, you’ll be able to import your tax information into the FAFSA form right away using the IRS Data Retrieval Tool (DRT).

- 2023–2024 FAFSA: You (and your parents, as appropriate) will report your 2020 income and tax information.

During verification, our verification team compares information from the student’s FAFSA with all other required verification documents. Once the verification review is complete, necessary corrections to the student’s FAFSA may be needed. If needed, we will make the necessary corrections to the student’s FAFSA and submit them to the federal processor. Therefore, it is very important during or after verification that a student (or parent, spouse) NOT make any changes to the FAFSA as this will only delay the awarding and disbursing of Federal forms of aid such as the Pell Grant, Federal Direct Loans, and Federal Work-Study.

The Department of Education does not provide applicants with specific reasoning why their FAFSA was selected, as most are selected at random. The Department of Education uses a formula, not revealed to colleges and universities, to select applicants based on common data errors.

Please allow up to 4 weeks for processing Financial Aid awards. Always check your Gwinnett Tech student email account and Banner account, for additional information and requests.

- Use the IRS Data Retrieval Tool OR Request Tax Return Transcripts as soon as notified.

- Fill out all documents completely before submitting as incomplete documents can cause delays in the processing of your financial aid file.

- Always include the student’s full given name and student ID number on each document submitted.

- Keep a copy of all documents submitted for your records.

- Monitor the student’s Gwinnett Tech email account for requests for additional information and updates.

- Allow up to 4 weeks for processing.

Students can follow the steps to access the missing documents:

- Login to your account on Login.GwinnettTech.edu

- Click on “Student Services & Financial Aid”

- Go to the Financial Aid Folder

- Click on “My Award Information”

- Select “Award Package for Aid Year”

- Select the applicable Aid Year

- Scroll to bottom of the page to the last box and click on “Overall Financial Aid Status” in blue

- Click on “Student Requirements” in blue

Gwinnett Technical College uses CampusLogic to assist our students who are chosen for verification or have conflicting information from the results of their FAFSA (Free Application for Federal Student Aid). We also use CampusLogic for Satisfactory Academic Progress and Professional Judgment Appeals.

If you are required to submit documents, you will be notified. In this notification, you will be instructed to create a CampusLogic account (if you have not already created an account). The account you create will be checked against the information from your FAFSA application so please remember to enter your demographic information when creating your CampusLogic account just as you entered it on your FAFSA application.

We will notify students via their Gwinnett Tech student email if their verification is incomplete. We encourage students to check their Student Banner accounts often for updates regarding their financial aid status. You can check for missing or incomplete documents on your account by using the steps below:

- Login to your account on Login.GwinnettTech.edu

- Click on “Student Services & Financial Aid”

- Go to the Financial Aid Folder

- Click on “My Award Information”

- Select “Award Package for Aid Year”

- Select the applicable Aid Year, for example, “2022-2023”

- Scroll to the bottom of the page to the last box and click on “Overall Financial Aid Status” in blue

- Click on “Student Requirements” in blue

The Internal Revenue Service Data Retrieval Tool (IRS DRT) allows students and parents who filed a U.S. tax return with the IRS to access the tax return information needed to complete the FAFSA form and transfer the data directly into the FAFSA form.

The IRS DRT remains the fastest, most accurate way to input your tax return information into the FAFSA form. To address security and privacy concerns related to the IRS DRT, the tax return information you transfer from the IRS will no longer be displayed on the FAFSA or the IRS DRT web page. Instead, you’ll see “Transferred from the IRS” in the appropriate fields on FAFSA. Not everyone is eligible to use the IRS DRT and it does not input all the financial information required on the FAFSA form. Therefore, you should have your tax return and IRS W-2’s available for reference.

Students and parents who meet the following criteria, are given the option to use the IRS DRT to retrieve, display and transfer federal tax information on the FAFSA:

- Filed a tax return

- Has a valid Social Security Number

- Has an FSA ID and Password (If you do not have a FSA ID, you can create one by clicking on this link: StudentAid.Gov)

- The marital status has not changed since December 31

If any of the following conditions apply to students or parents, DO NOT use the DRT if:

- An amended federal tax return was filed

- A federal tax return was not filed

- The federal tax filing status is “married, filing separately”

- The marital status from January 1 through May 11 has changed

- A foreign tax return was filed

If student or parent is unable to use the IRS Data Retrieval Tool on the FAFSA and the student is selected for verification, they will be required to submit tax documents. Students and parents can submit a Tax Return Transcript from the IRS or a 1040 with a hand-written signature for the requested year. We will not be able to accept an IRS Account Transcript or an unsigned 1040 form.

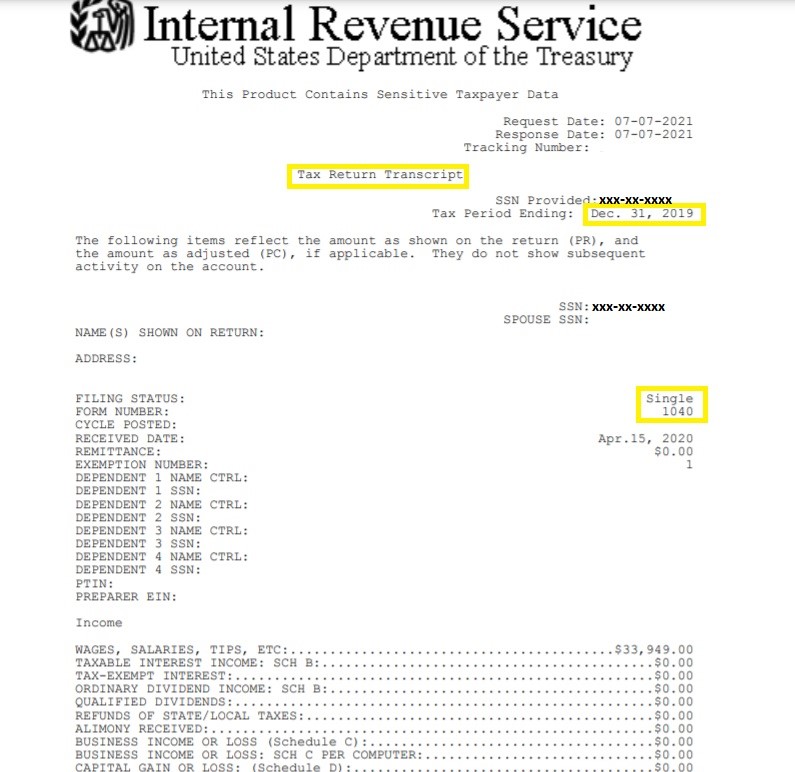

Tax Return Transcript Sample

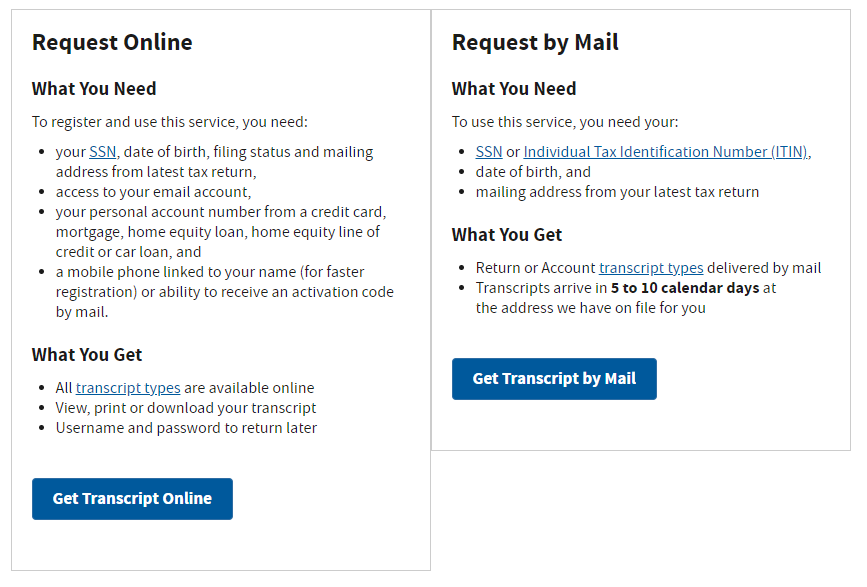

You can order a Tax Return Transcript on the IRS.Gov website. To order the Tax Return Transcript online, you will be required to make a profile account with the IRS by clicking on the Request Online Option. If you are unable to make an account, you will select the Request by Mail option and the IRS will mail you a copy of the Tax Return Transcript. Follow the link to order the Tax Return Transcript from the IRS: https://www.irs.gov/individuals/get-transcript

Below is a screen shot of the ordering options on the IRS website

Telephone Requests:

- Call the IRS Transcript line at: 1-800-908-9946

- Follow prompts and enter Social Security # and address

- Choose “Option 2” – request an IRS Tax Return Transcript, enter the appropriate tax year.

- Once you receive confirmation of a successful request, a Tax Return Transcript will be mailed within 5 to 10 business days (phone requests for IRS transcripts CANNOT be sent directly to the Office of Financial Aid or other third parties).

The FAFSA application requires dependent students to provide information about a student’s LEGAL parents (biological, adoptive and step-parent). The following people are NOT considered parents on the FAFSA (unless they are considered adoptive parents): grandparents, foster parents, legal guardians, older brothers or sisters, and uncles or aunts.

Under certain circumstances, the student DOES NOT need to include parent information, if:

- The student is in Legal Guardianship: A legal guardian is NOT considered a parent in the financial aid process (the verification will require additional documentation needed to verify Legal Guardianship status in order to determine and consider a student’s dependency status)

- The student has foster parents: A foster parent is not considered a parent in the financial aid process (the verification team may require additional documentation in order to determine and consider a student’s dependency status).

Indicate the parent marital status as of the day you submit your Free Application for Federal Student Aid (FAFSA). The FAFSA considers five marital status categories for parents of dependent students based upon a parent’s particular marital status. Parent marital status affects what additional information is needed for other FAFSA questions; therefore, it is IMPORTANT to answer the parent marital status questions accurately. Following is a list of the five marital status categories including information on how to answer FAFSA questions based on that marital status:

- Never married: a (single) parent who was never married and does not live with the student’s (other) legal parent, or a parent who is widowed but not remarried. Answer questions about that parent.

- Unmarried and both parents living together: a student’s legal parents who are not married but live together. Provide information about BOTH parents. Do not include any person who is NOT married to the student’s parent and who is NOT a legal or biological parent.

- Married or remarried: legal parents (biological, adoptive or step-parent) who are married and/or living together. Consistent with the Supreme Court decision holding Section 3 of the Defense of Marriage Act (DOMA) unconstitutional, same-sex couples MUST report their marital status as married if they were legally married in a state or other jurisdiction (foreign country) that permits same-sex marriage, without regard to where the couple resides. NOTE: If legal parents are divorced but LIVING TOGETHER, answer “Unmarried and both parents living together.” If legal parents are SEPARATED BUT LIVING TOGETHER, answer “Married or remarried,” NOT “Divorced or separated.”

- Divorced or Separated: legal parents (biological, adoptive or step-parent) who ARE NOT living together. Provide information about the parent that you lived with most during the last 12 months. If you did not live with one parent more than the other, provide information about the parent who provided most of your financial support during the last 12 months.

- Widowed: If a widowed parent is unmarried, answer questions about that parent. If a widowed parent is remarried as of the date of the FAFSA submission, answer questions about parent and step-parent.

Reporting step-parent information does not require a step-parent to offer financial assistance to the student for educational expenses. However, if a legal parent (biological or adoptive) is divorced and remarried, then step-parent information (including income and assets) is considered an important aspect of the family’s financial situation. The step-parent’s information will be required for the calculation of the Expected Family Contribution (EFC) which determines a student’s eligibility. Including step-parent information on the FAFSA provides an accurate picture of the family’s total potential to pay college costs.

- If a student was married BEFORE submitting the FAFSA, then the student may be considered independent.

- If the student was married AFTER submitting the FAFSA, the student must contact the Office of Financial Aid for more information regarding independent status.